How to Charge Tax on Shopify: The Ultimate Guide

Learning how to charge tax on Shopify is crucial if you’re running an e-commerce store with customers in various parts of the world. Ensuring you’re collecting the right amount of sales tax from your customers, based on their country or region, means you can remain compliant with tax laws and avoid having to pay hefty fines out of your own pocket.

As one of the most popular e-commerce platforms in the modern world, Shopify offers a variety of tools to assist retailers in staying on top of sales tax. However, charging tax on the platform can be a little more complex than it seems if you’re not a Shopify expert. You’ll need to make sure you’re implementing the correct settings and collecting the right data to file your tax reports.

While dealing with sales tax can be a daunting concept for many business leaders, it is an essential part of making sure you run a successful, profitable, and compliant business.

Here’s everything you need to know about charging tax on Shopify.

Sales Tax for Shopify Merchants: An Introduction

Sales tax is a common consumption tax imposed by governments around the globe on the sale of goods and services. If you’re operating in the US, Canada, the UK, and various other regions, you’ll need to ensure you’re adhering to the sales tax requirements of your country and state.

Notably, while sales taxes are collected from the customer at the “point of sale,” such as your checkout page on Shopify, it’s up to you to check you’re collecting the right taxes and delivering them to the government. If you don’t follow the process correctly, you’ll have to pay sales taxes out of your own pocket, which can significantly eat into your profits.

The good news for Shopify merchants is that the platform offers a high level of tax compliance with a host of valuable tools, such as sales tax liability insights, to help you decode each state’s regulations, product categories for overriding specific tax rules, and enhanced tax reporting capabilities.

Shopify offers a range of “default state tax rates,” which are updated regularly based on the latest insights from the economic landscape. While these tax rates are generally accurate, you’ll need to make sure they’re correct for your particular circumstances.

Additionally, it’s worth remembering Shopify won’t remit or file sales tax for you. You’ll need to make sure you register your business with your local or federal tax authority, and you might want to consider working with an accountant to prepare your tax reports and ensure compliance with Shopify 1099 requirements.

Charging Tax on Shopify: Getting Started

Before learning how to charge tax on Shopify using the platform features, you’ll need to get a good idea of when, where, and how you should be charging tax. The first step is determining where you have a “nexus” as a business owner. This is the term used to refer to instances where you meet the requirements for a business in a specific space to pay sales taxes.

In the past (before 2018), having nexus as a business owner meant owning a physical presence, such as a store or warehouse. However, now, nexus can exist based on either your physical or economic presence in a state. In other words, if you generate enough sales in a specific region, you’ll be required to pay sales tax on those sales.

In the US, the economic nexus for each state can vary. For instance, Texas deems companies to have an economic nexus when they make sales in the state exceeding $500,000 in a year, while Illinois only requires companies to make $100,000 in sales. You can find some useful guidance on the Shopify website covering how you can determine your tax liability for each state.

It’s also worth making sure you understand the tax sourcing rules for each stage. For instance, some states focus on origin-sourced sales, which are taxed according to where the seller is located, while others look at destination-sourced sales, taxed according to where the buyer takes possession of an item sold to them. Once you’ve determined your tax liability and nexus and understand where and how you’ll be charged sales tax based on your store’s presence, you’ll need to check your products are taxable. While most tangible items are taxable, there are some that are exempt from sales tax or may be subject to a specific rate.

Additionally, you may need to register for sales tax permits in the states where you’ve determined you have nexus. This involves going to your state’s department of revenue website, or contacting the department to apply for registration. Most sales tax permits are free, but there are states where you may be charged for your application. Once you’ve registered for sales tax, you can upload your details into Shopify, which will help you with overriding tax rules and creating tax reports.

How to Charge Tax on Shopify: Step by Step

After you’ve figured out where you need to be charging sales tax and what kind of rates you’ll be subject to, you can start setting up your Shopify store with the right settings. Learning how to charge tax on Shopify is relatively straightforward, but it does require a number of steps.

For instance, if you’re charging tax on Shopify for the first time, you’ll need to choose your preferred service. Options include Shopify tax (automated tax rates), basic tax, or manual tax. The easiest option is to use Shopify tax, as this will automatically collect sales tax at the checkout using location and product-specific rates. Once you’ve chosen your option, you can use the following steps to modify and optimize your Shopify state sales tax strategy:

Step 1: Tell Shopify Where to Collect Tax

The first step is providing Shopify with information on where the system needs to collect sales tax from shoppers. Shopify allows business owners to enable tax for US purchases (on a state-by-state basis), as well as Canadian transactions and purchases in the EU and UK. You can also find solutions for duty and import taxes in the Shopify platform, GST in India, TSE in Germany, and taxes in Japan.

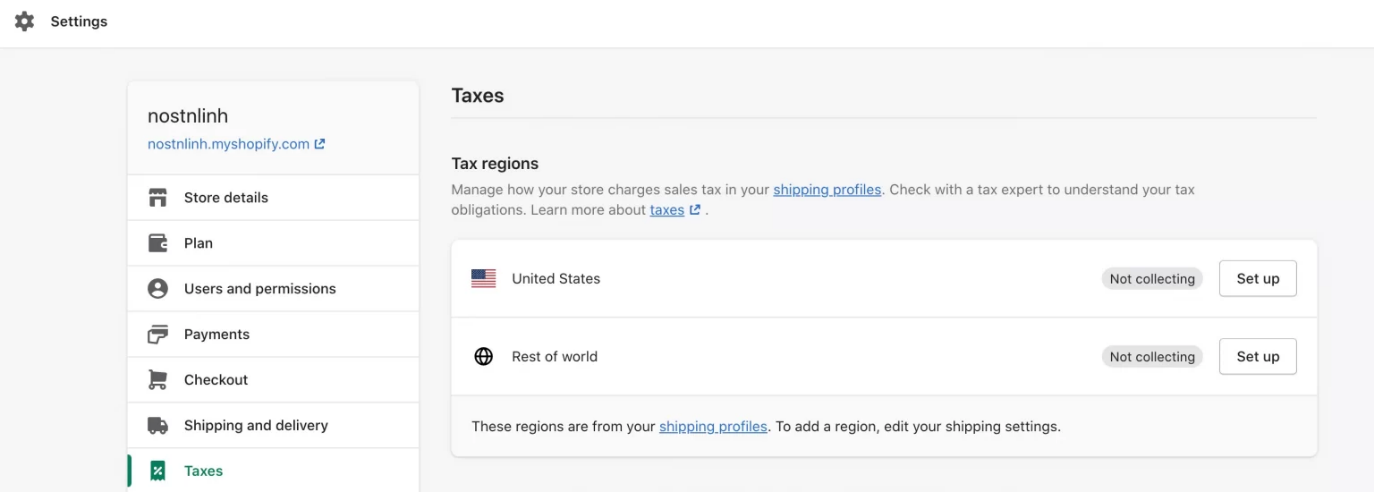

To begin charging tax on Shopify, log into your account, click on Settings, and then choose the Taxes option. You’ll see an option to choose your Tax Region here. Select the country you’re going to be charging sales tax in, and click on Set Up.

When you head into the tax settings page, you’ll be able to enter the states you’ll be collecting taxes. Shopify can automatically provide insights into your tax liabilities based on where you’re selling products. Check you’ve included all of the correct states and locations, then click on Collect sales tax. This will launch a pop-up window on your screen.

Enter your state name and sales tax ID into the sections provided. If you don’t have your ID yet, you can leave the section blank and come back to it later.

Step 2: Optimize Tax Calculations

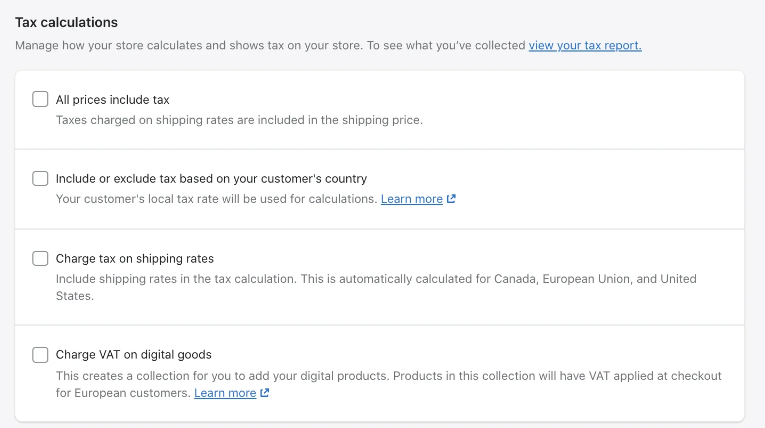

Once you’ve finished entering all of the correct data into the Tax Regions section, you can scroll down the page to see the Tax Calculations options. These give you four choices for how you want to calculate taxes for your store.

You can choose between:

- All prices include tax: Taxes will be applied to all products and included in the shipping cost.

- Include or exclude tax based on country: Shopify will automatically determine what type of tax rate to implement based on your customer’s location.

- Charge tax on shipping rates: This allows you to include the shipping rates for products in the tax calculation for US, Canada, and EU transactions.

- Charge VAT on digital goods: This allows you to add VAT to digital products at checkout for European customers.

You can check more than one box in this section. So, for instance, if you’re selling digital products in the EU and selling physical products around the world, you could select the second and fourth options. If you’re not sure about your tax and VAT liabilities still, it’s worth talking to an accountant.

Step 3: Implementing Tax Overrides

While Shopify calculates taxes automatically on your behalf, it is possible to override these tax rates if you know you need to charge specific amounts. This allows you to control how much tax you charge for each product, handle exemptions, and specify tax-exempt customers.

For instance, you could apply overrides for sales tax in tax-exempt countries throughout the US or implement VAT exemptions for the UK and EU.

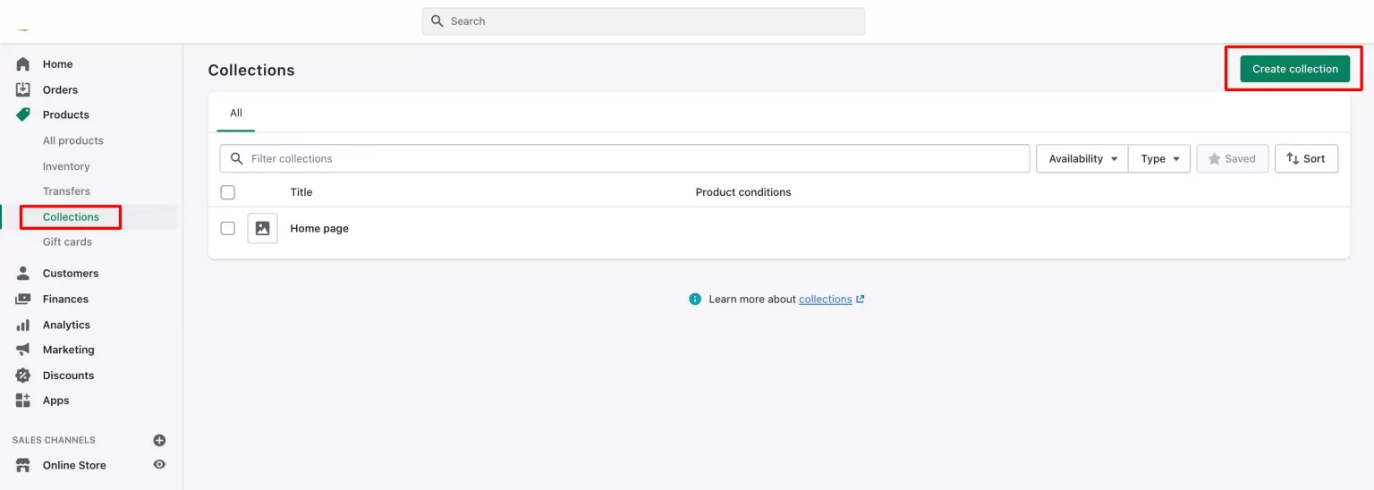

Overrides on Shopify will apply to both your POS sales and online sales; however, they do require a little work to set up. You’ll need to start by creating a manual collection for any products that are tax-exempt. To do this, go into the Collections page within the Products section of your Shopify store, and click on Create Collection.

Name your collection so you can keep track of it, and choose the Manual collection type from the range of options. Once you have your collection, go back into the Taxes section of your Shopify Settings page, and click on Tax overrides.

Select Add Product Override and select the collection you’ve created alongside the region in which the override will apply. You can then enter the new tax rate for that region.

Step 4: Leveraging Other Tax Resources on Shopify

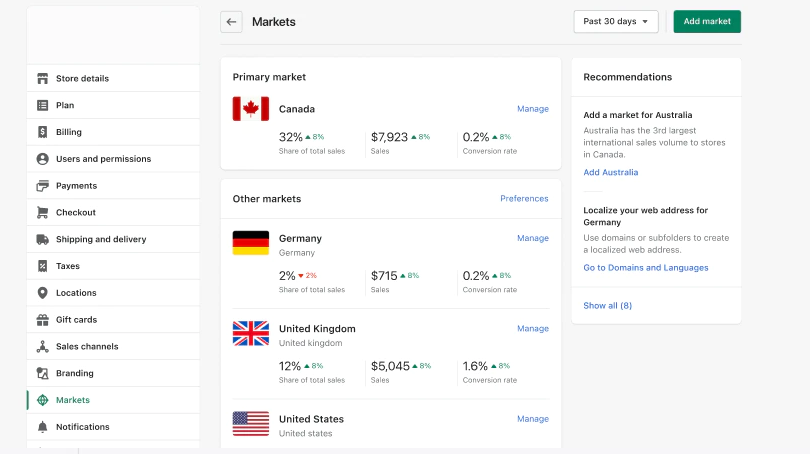

Aside from using overrides to manage your tax requirements, it’s worth noting you can also leverage a variety of other tools within Shopify to deal with tax issues. For instance, if you’re selling in international markets, you can use the “Shopify Markets” service within the Advanced Shopify or Shopify Plus plan to manage duty and import taxes.

You can also update your tax settings to reflect your tax registrations within any Shopify account. While this doesn’t influence how tax is charged on your products, it does allow you to maintain more control over your tax settings, such as overrides and customer exemptions.

For EU customers, there are options to implement VAT options for digital products and tax rounding measures for various other items. You’ll also be able to implement tax overrides and settings for your Shopify POS system if you also use Shopify for offline selling.

If you’re a Shopify Plus customer, you can also take advantage of the Avalara AvaTax paid service, which automates tax calculations for filing. The service provides insights into real-time tax rates from over 12,000 tax jurisdictions.

Step 5: Preparing and Filing Tax Reports

Finally, once you’ve implemented all the right settings for charging tax on Shopify, it’s worth making sure you’re prepared to create and file your tax reports. The level of reporting detail required for each state can vary, so it could be a good idea to access assistance from a tax consultant if you’re unsure.

If you have particularly complex r requirements to adhere to because you’re selling on various channels or accepting payments from customers in various countries, there are various additional tools and resources that can help you in the Shopify marketplace.

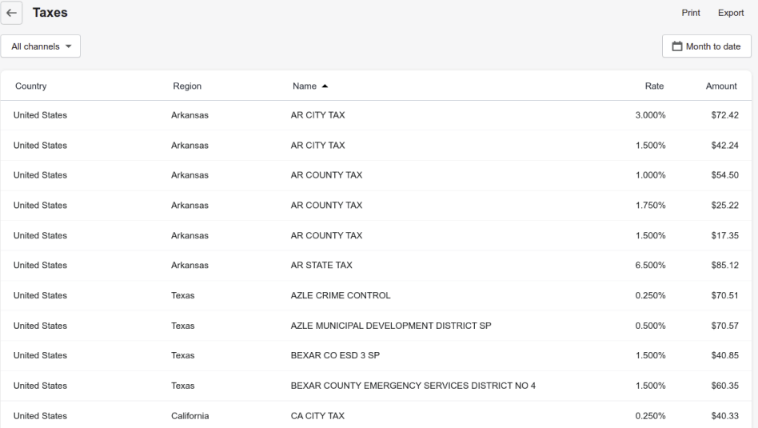

However, Shopify does offer a handful of tax reports as standard to assist you in filing and remitting your taxes. The Taxes finance report provides a summary of all the sales taxes applied by your store, while the sales finance report provides insights into order amounts, taxes, shipping locations, and billing. Both reports will be very useful when filing your return.

Keep in mind if you don’t collect sales tax during a taxable period due to your products being exempt, some states will still require you to file a “zero return.” If you forget to do this, you can receive a penalty similar to if you fail to file your taxes when you do have sales to remit.

Useful Apps for Charging Tax on Shopify

While you can manage most of your tax needs within Shopify directly, there are some useful apps and add-ons you can consider using if you need some extra help. The Shopify app marketplace is brimming with useful tools for creating and exporting custom reports, such as:

- PayHelm: PayHelm is a comprehensive e-commerce reporting tool that provides access to dozens of useful reports on taxes, fees, inventory, profits, COGS, and other factors. You can export data and integrate it with other services, access visualizations, and share your reports in a range of different formats. There’s a free trial available, and then the paid service starts at a price of $10 per month for a single staff user.

- Sidr: Designed for Shopify state sales tax in the US, Sidr Tax is an app that allows companies to immediately generate US tax reports for accurate filing. There’s a comprehensive analytics dashboard, access to accurate refund handling tools, and exportation options for your reports. Prices start at $20 per month.

- Eurora Tax: For European retailers, Eurora Tax automation gives merchants an easy way to automatically process and report sales tax directly to authorities. The solution comes with tools for tracking VAT compliance, but it does have a $4.90 registration fee and a subscription cost of around $49 per month.

Charging Tax on Shopify: Finishing Thoughts

Learning how to charge tax on Shopify can seem like a daunting process, but the platform does have a lot of useful tools to get you on the right track. Following the steps above, you should be able to implement the right tax rules quickly and easily, based on your business selling locations.

Keep in mind it’s always helpful to have an expert on hand if you’re struggling with tax calculations and remittance. While Shopify has its tools to guide you through the process, you may still struggle with ensuring your compliance if you’re selling in a lot of different countries and states.

Working with a professional tax consultant, accountant, or Shopify tax expert could improve your chances of avoiding unnecessary fines and penalties. Reach out to Toptal today to learn more about how our freelancers can help you optimize your business.

Shopify Sales Tax FAQ:

Can Shopify file my taxes?

While Shopify can automatically handle many of your tax calculations for you, it won’t be responsible for remitting the funds you collect. You’ll still need to download your own reports from the Shopify platform and file your taxes yourself.

Does Shopify report to the IRS?

Yes, it’s important to remember that Shopify does share information with the IRS about account owners and their transactions. This means you could end up in some serious trouble if you’re not charging and remitting sales tax correctly.

How much tax does Shopify charge?

Shopify automatically applies tax rates to purchases based on the locations of your customers or the override settings you implement. The company bases its tax rate on the available data gathered from governments around the world.

Can Shopify help with tax compliance?

There are tools available on Shopify that can assist with tax compliance. For instance, if you’re a Shopify Plus account owner, you can leverage the Avalara AvaTax service to create your tax reports and ensure you maintain accurate records.

Does Shopify support duty and import taxes?

Yes, alongside sales tax, you can use Shopify to implement duty and import taxes on transactions when necessary, using Shopify Markets. However, you will need an Advanced Shopify plan or Shopify Plus to use this service.