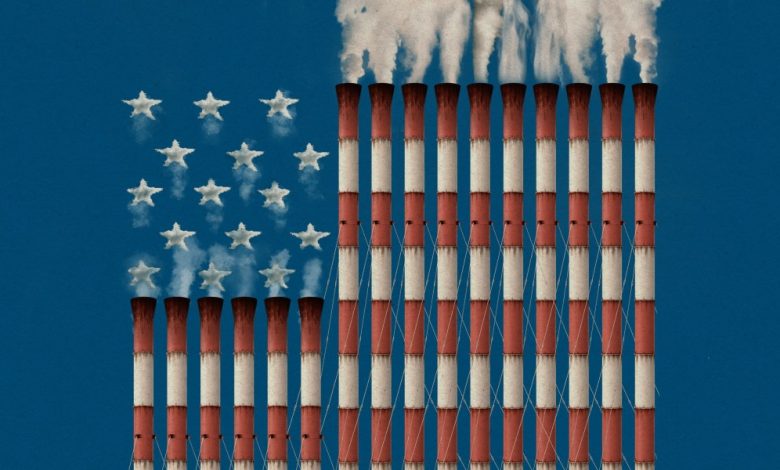

Experts warn the US must do more to boost demand for carbon removal

As Heatmap previously reported, Heirloom has pre-sold a “substantial” portion of the capacity for the two projects it is now planning in the state to customers including JPMorgan Chase, Klarna, Meta, Microsoft, and Stripe.

Occidental’s first industrial-scale DAC project, the Stratos plant in Ector County, Texas, is expected to come online next year. The company’s 1PointFive subsidiary is developing the project and has announced customers including AT&T, Amazon, Microsoft, and Trafigura.

The company didn’t respond to a question concerning whether it has lined up deals for the separate DAC Hubs–funded project. But Michael Avery, president of 1PointFive, said in a prepared statement: “We’re continuing to see increasing understanding and interest in the importance of highly-durable CDR solutions like direct air capture to address residual emissions across several industries.”

Last month, the DOE’s Office of Clean Energy Demonstrations said it would provide up to $1.6 billion to a variety of additional DAC facilities, as well as the infrastructure that would support them, which might include storage wells and pipelines.

Notably, the agency significantly reduced the size of the facilities that might qualify for the second tranche of grant funding. Rather than million-ton facilities, the office said, it would likely look for “mid-scale projects” that could remove 2,000 to 25,000 tons of carbon dioxide per year and “large-scale” ones that capture at least 25,000 tons. It also stated that it plans to use some portion of the remaining funds “to support current and future awardees in addressing key barriers or major industry challenges that fall outside the original award scope and budget.”

Industry observers interpreted that to mean the office was seriously considering the growing calls to provide more demand support for carbon dioxide removal (CDR). That could take the form of direct government procurement of tons of carbon removal that could be applied toward the nation’s goals under the Paris climate agreement or federal subsidies that help defray the cost of corporate purchases.

Andreasen and Amador both said the DOE should allocate up to $500 million from the original $3.5 billion toward such efforts. Repurposing that money may mean building fewer or smaller plants through the DAC Hubs program, but it could increase the odds of success for those that do get developed.

A public good?

Breakthrough Energy isn’t a disinterested observer. The venture arm of the organization has made multiple investments in the carbon removal industry. For that matter, it’s not unusual for an industry organization, like the Carbon Removal Alliance, to call for governments to bestow tax breaks, subsidies, or other forms of federal assistance on its members.

The US already provides significant support for the industry on top of the DAC Hubs funding, including a subsidy of up to $180 for every ton of carbon dioxide removed by a direct-air-capture plant and then permanently stored underground.

The DOE’s Office of Fossil Energy and Carbon Management has started a pilot effort to directly purchase carbon removal last year, with $35 million in available funding. In May, it revealed a list of 24 semifinalists for the purchase contracts, including Charm Industrial, Climeworks, Ebb Carbon, Heirloom, and others. The office intends to select up to 10 companies that could receive as much as $3 million for the sale of removed carbon dioxide when those tons are delivered.