4 Reasons Why Payment Innovations are Propelling the Phygital Boom in Retail

Positive CX is no longer defined by singular high street experiences or online storefront browsing alone. Today, retailers must go phyigital. To succeed in a densely populated retail landscape, brands need to build consistent customer journeys that cover all touchpoints from in store to online.

Think digital kiosks and click-and-collect. The digitalisation of in-store shopping experiences has already begun.

Today’s consumers are driven by personalisation and convenience. One sector propelling the transformation of shopping habits, is the payments sector. As we continue to welcome mobile wallets, contactless payments and buy-now-pay-later schemes, purchase innovation in undoubtably changing the checkout experience.

With this in mind, let’s dive headfirst into what the ‘phygital’ movement could mean for your retail brand and discuss how payment innovation is propelling the sector’s digital explosion.

What is Phygital Retail?

‘Phygital’, otherwise known as a combination of the words physical and digital is the term used to describe a retail strategy that merges online and in store touchpoints for a seamless customer experience.

For example, customers that choose to click and collect a product online, before heading into store, interact with both physical and digital touchpoints in one customer journey.

Phygital retail continues to dominate the transformation of the high street in 2024. Not only have phygital experiences such as click-and-collect seen an increase of more than 554% more users since 2020, but new innovations that promise to blur the links between physical and digital shopping continues to evolve.

In 2024, here are just a few examples of phygital retail strategies your store could adopt:

- Self-service digital kiosks

- Virtual try-ons using Augmented reality (AR) and virtual reality (VR)

- Contactless payments and digital wallets

- Integrated POS systems that create online customer profiles

- Mobile apps for in-store and online shopping

- Social commerce and QR code payments

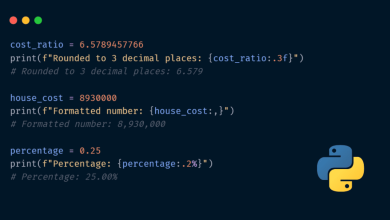

Take Amazon Fresh, for instance. This is a great example of a phygital in-store experience. Merging the traditional in-store shopping experience with a simplified online checkout, Amazon allows customers to shop cash and card-free, simply using sensors to add each item to a digital basket for an online checkout.

(Image Source: The Verge)

The defining feature of Amazon Fresh’s success is the simplicity of the checkout process.

The question is, how else will digital payment innovations affect future phygital retail experiences? Let’s find out.

Could Payment Innovations Propell Retail’s Phygital Future?

Payment innovation sits at the heart of retail’s phygital evolution. As we welcome a wider choice of payment options at the checkout, retail brands are able to give customers more choices, elevate in-person experiences and effortlessly blur the lines between in-person and online shopping.

Here are four ways the digitalisation of the payment industry could transform retail as we know it.

Giving Customers More Choice

One of the most significant positives we’ve seen from the payment sector’s impact on phygital retail is the introduction of more choices for customers who can’t decide between in-store and online when it comes to interacting with a brand.

While in-store and online shopping was once a black-and-white process, the innovation of digital payment options continues to blur the lines.

Customers can now interact with physical and digital touchpoints when purchasing a product, thanks to checkout options such as click-and-collect, buy online, pick up in-store, and buy in-store and deliver home.

“It’s all about giving customers a choice – providing options of how they want to interact with your brand and buy, how they want their products delivered, and what services they want to take advantage of in-store,” says Mike Hughes, head of Schneider Electric’s digital commerce operations. “This choice is what keeps customers loyal and allows them to choose the right journey that suits their needs at that moment.”

Elevating In-Person Experiences

Digital payment trends also have the ability to elevate in-person experiences in a physical retail store.

As brands introduce self-serve digital payment kiosks and a POS system for a retail store, customers can enjoy cashier-free shopping and a frictionless checkout experience.

Integrated POS systems also take the phygital retail experience one step further. With the ability to store purchase data and build profiles for returning customers, POS systems can offer customers personalised discounts based on predicted purchases.

Better still, electronic POS systems integrate with a brand’s online store too, meaning that data from conversions at all touchpoints are stored and used to build loyalty points and a customised customer profile for seamless future shopping experiences.

Personalising Payment Options

The introduction of more payment methods certainly propels the phygital boom in the retail sector.

As we welcome contactless payments, device-led payments, and even buy-now-pay-later, customers can now pay for their in-store goods digitally.

Take buy-now-pay-later, for example. For products with larger average transaction values (ATV), such as electronics or furniture, the BNPL innovation makes these in-store products more affordable, in turn increasing the number of high ATV purchases on the high street.

Jumping On the Mobile Wallet Trend

Mobile payment innovations are forcing retailers to jump on the mobile wallet trend and propel their ascent into a phygital future.

Almost all of us carry a mobile in 2024, and more than half of us are more likely to have our phone in our picket as a pose to our wallet.

Mobile wallets are the payment sector’s newest innovation in the last decade, allowing customers to make a payment using their device online.

3 in 4 young people now only make payments using Apple Pay, Google Pay, or Samsung Pay, which has forced retailers to adopt a digital-first store strategy.

This is not only more convenient for the customer, but merchants can also use mobile card data to collect information on customer shopping preferences and historical purchases in-store.

What’s Next For Phygital Retail?

Phygital retail could become the new normal for high street brands and online stores in 2025.

It’s no secret that innovative payment trends like BNPL and the introduction of digital wallets drive more retailers to embrace a modernised checkout experience.

As we continue to blur the lines between online and offline storefronts, the retail industry is heading towards a phygital future.

The post 4 Reasons Why Payment Innovations are Propelling the Phygital Boom in Retail appeared first on Datafloq.