CPG’s DTC Evolution: Decoding the Strategic Shift

Digital interactions and online transactions are table stakes across most industries these days. While a few companies are raising the bar on innovation, most are lagging behind on the maturity curve and trying to catch up. Today, no industry is as impacted by the need for powerful online interactions and transactions as consumer packaged goods (CPG). This industry’s digitally savvy consumers have constantly rising expectations that are colored by their experiences across a wide array of other industries and platforms. The direct-to-consumer (DTC) model has played a pivotal role in transforming the CPG industry, but is there a future for DTC in CPG? Or will trailblazing CPG companies drive the industry in another direction?

As Toptal’s Digital Customer Experience Practice Lead, my work spans a diverse range of clients within the CPG sector, from disruptive startups—DTC natives, in this context—to Fortune 500 corporations. A consistent insight from serving CPG clients is the significant role DTC plays in their forward-looking strategies—an observation shared by Toptal’s DTC sales lead Brennan Shanks. Whether as a supplementary approach to bolster first-party data or a fundamental aspect of their channel strategy, virtually every CPG company is exploring ways to align with future consumer expectations. If you’re not, you should. My enthusiasm for human-centered design and understanding consumer behavior informs my view that these expectations encompass digital engagement, online shopping, hyper-personalization, and a synergy between brand identity and individual values—hallmarks of a genuine DTC approach.

However, transforming an organization to effectively deliver on these fronts, especially for well-established entities burdened by legacy systems and a lack of data maturity, is no small feat. There is no universal blueprint for executing a DTC strategy that guarantees a CPG company’s optimal positioning for the future. Nonetheless, it is feasible to select a path that closely matches a company’s risk tolerance and business goals. Here’s how smart CPG companies can plan their DTC futures to remain market leaders.

From Shelves to Screens: The Evolution of DTC

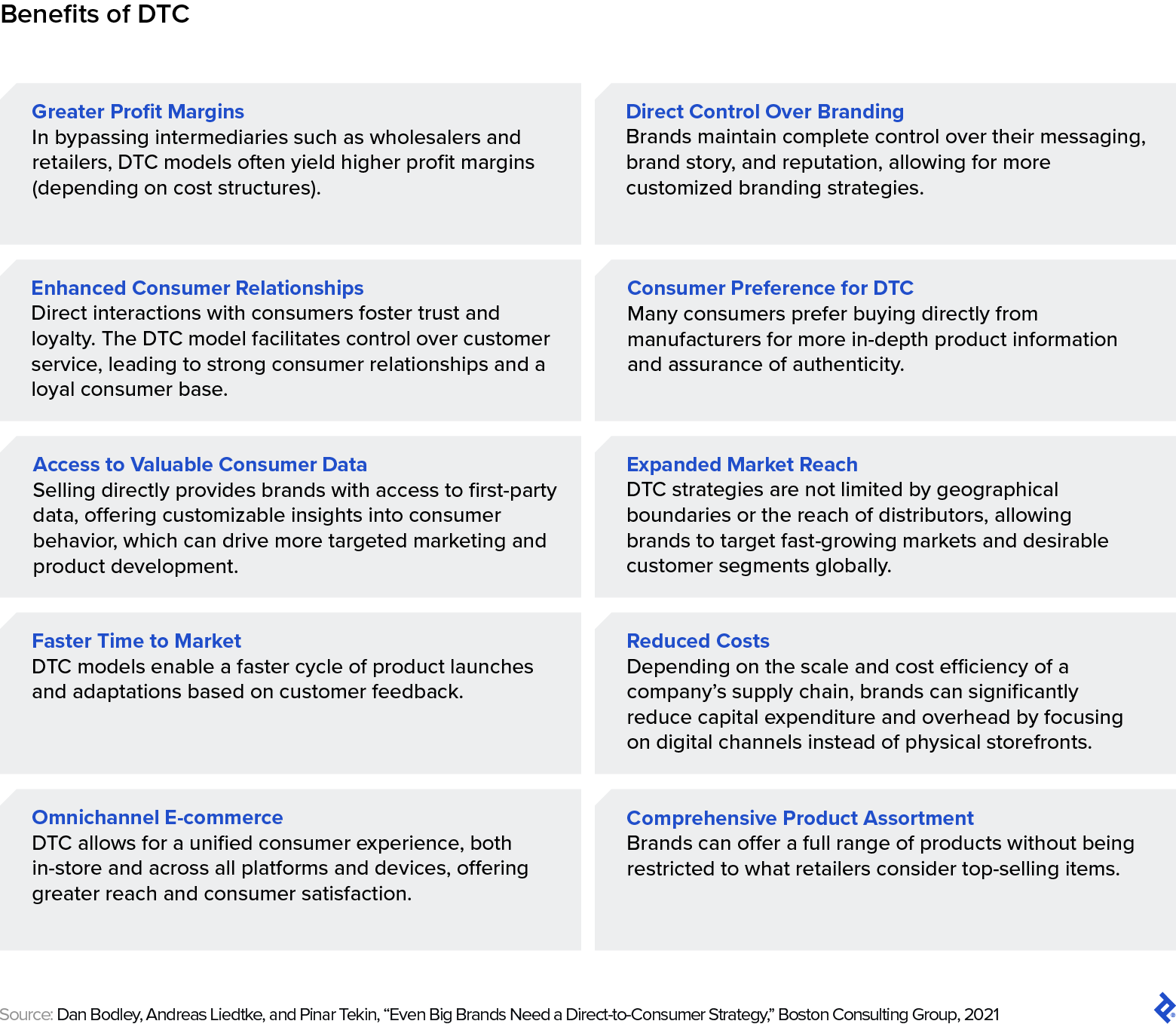

The DTC model in the CPG industry has disrupted traditional commerce paradigms, reshaping consumer engagement and how brands deliver products. Originally defined as a sales model where brands sell directly to consumers and skip intermediaries such as retailers, DTC has evolved beyond transactions.

The global DTC market has experienced significant growth over the past few years, reaching approximately USD 301.79 billion in 2023 and a projected market value of USD 468.18 billion by 2032. In terms of market dynamics, DTC sales currently account for nearly one in seven e-commerce dollars globally, a proportion that’s expected to increase rapidly. Growth in DTC is part of a broader trend in e-commerce, which saw substantial expansion during the COVID-19 pandemic. Retail e-commerce sales experienced an increase of more than 26% in 2020 and more than 16% in 2021, with DTC being one of the highest-growth categories. In 2020 alone, DTC sales grew by nearly 45%. This surge is interlinked with the overall increase in e-commerce activities during the pandemic.

Toptal Case Study

One Fortune 500 CPG client asked Toptal to support their entry into the DTC space with the goal of collecting rich consumer data as part of their overall digital journey. This was a complex undertaking for a traditional CPG company that needed to stand up many foundational elements (e.g., an e-commerce platform, fulfillment strategy, and customer support) while also managing relationships with their wholesale channels. I recommended a brand-by-brand approach, and the value generated was immediate, with the consumer data feeding directly into product development and marketing. The impact? While DTC accounts for a fraction of the company’s overall revenue, it is now an integral part of their overall strategy. The data and insights generated enrich their product development, planning, and marketing, generating exponential brand value and customer traffic for their retail partners.

CPG companies embrace DTC for various reasons, from increasing sales and controlling brand experiences to capturing first-party data for innovation and personalization. Each company’s approach to DTC can vary, too, including creating fully accessible e-commerce brands, DTC-specific brands, or even making distinct acquisitions. Take, for example, Harry’s versus Gillette. Harry’s disrupted the shaving market by launching subscription-based products that are primarily DTC. Harry’s razors and replacement blades were initially priced lower than Gillette’s. Gillette’s response was to create an innovation hub called Gillette Labs. They created a waitlist for their new product launches through their DTC site, which also captured first-party data. They are now expanding their omnichannel marketing via TikTok and influencer-based sites.

While Gillette recognizes the importance of retail partners, DTC is their lifeblood for collecting data and insights and reaching new audiences—something DTC native companies easily gain access to by offering personalized services, subscription models, and brand alignment. This model caters to consumers who demand value, personalization, sustainability, and immersive experiences. Successful DTC natives, like sleep-products company Casper, create ecosystems through partnerships and expanding into physical spaces to enhance customer experiences and reach new audiences. For established CPG companies, like Gillette, entering the DTC space is a defensive strategy that requires clear objectives in order to maintain market leadership, gain access to valuable data, and compete against DTC native companies.

Toptal Case Study

Another top client, arguably the world’s largest tool company, asked Toptal to help them spearhead their entry into the DTC space with the goal of working hand in hand with their retail partners while capturing additional value directly. The strategy Toptal helped shape included building out the e-commerce platforms for their channel partners on each brand’s site as well as listing alternative SKUs that retailers didn’t traditionally carry due to the vast number of goods sold. This approach allowed them to partner and not compete with retailers, which led to strengthened relationships and an immediate increase in revenue.

The North Star: Setting DTC Objectives

Prior to joining Toptal, I served in execution-focused roles across customer, innovation, digital, and growth, and as a strategy consultant with Booz & Company. While forecasting the future and devising strategies is fun, success lies in execution. The journey toward a successful DTC implementation begins with defining clear, achievable objectives. DTC objectives are intrinsically linked to the benefits that this model offers. Identifying the primary objective for a DTC initiative is a multifaceted process that involves:

- Consumer Insight: Understanding consumer needs and expectations is crucial. This involves gathering and analyzing qualitative and quantitative data through methods like surveys and focus groups.

- Market Research and Competitor Analysis: Assessing the market landscape and competitor strategies is vital. This helps identify gaps in the market, competitive advantages, and effective brand positioning.

- Business Analysis: Reviewing internal business metrics such as revenue trends, product category performance, and regional market dynamics provides insights into potential areas of growth or improvement.

- Ideation and Prioritization With Leadership: Collaborative brainstorming sessions with the company’s leadership and board are essential. These discussions should focus on aligning the DTC objectives with the company’s overall vision and strategy.

- Board and Leadership Alignment: The primary DTC objective needs to be a top-down decision, fully understood and supported across the business. This ensures that everyone is aligned and equipped to make decisions that are consistent with the agreed-upon goal.

For a DTC strategy to be effective, it must be embraced across the organization. This requires clear communication, training, and perhaps most importantly, demonstrating how the DTC objectives align with the overall success of the company.

Once the primary objective is set and communicated, it becomes the North Star for all DTC-related decisions and strategies. This guiding principle should be reflected in every aspect of the DTC transformation, from marketing and sales to logistics and customer service. Regular reviews and adjustments may be necessary to ensure that the DTC strategy remains aligned with the evolving market and consumer trends.

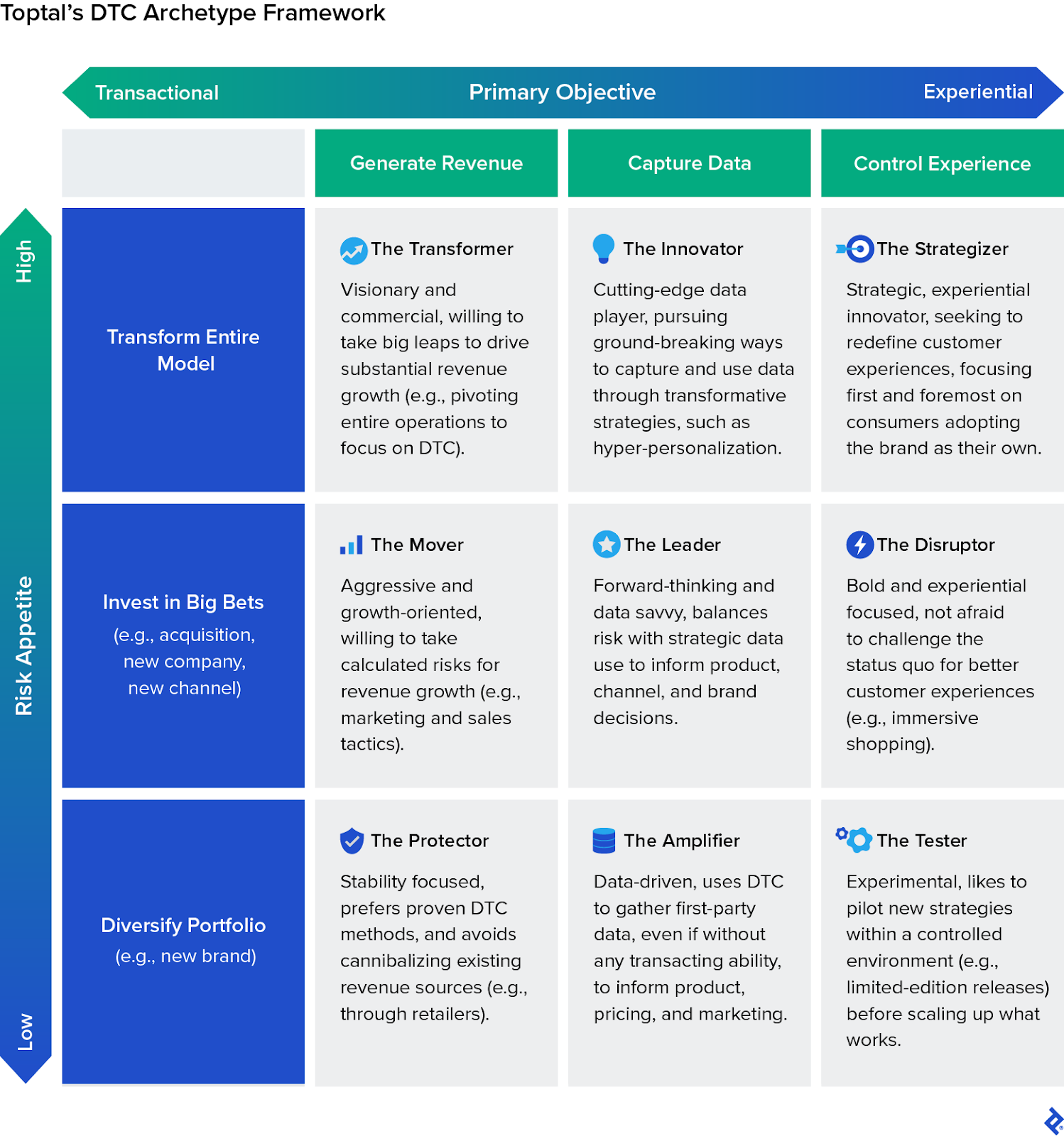

Choosing Your Path: The DTC Archetypes

At Toptal, we have experience working with a range of CPG companies, from established global brands transforming into digitally enabled portfolios maintaining both retail and DTC channels to digital natives launching their e-commerce operations to new audiences. Based on this experience, we have developed a proprietary framework of DTC archetypes, an intuitive tool for understanding and strategizing in the evolving world of DTC business models. At its core, Toptal’s DTC Archetypes Framework is structured around two critical dimensions: Primary Objective and Risk Appetite.

Primary Objective: This dimension categorizes companies based on their primary goal—which may shift over time—in the DTC space. All higher-order objectives usually drive outcomes at the lower levels, and companies should aim to continuously progress toward the right. The objectives are:

- Generate revenue

- Capture data

- Control brand experience

Risk Appetite: This dimension assesses a company’s willingness to take risks (strategic, financial, cultural, and brand) and doesn’t as easily shift over time. The levels are:

- Low: Diversify portfolio (e.g., launching a new brand)

- Medium: Invest in big bets (like acquisitions, new companies, or new channels)

- High: Transform the entire business model

The intersection of these dimensions results in a three-by-three matrix, creating nine unique DTC archetypes. Each archetype embodies a distinct approach to DTC, characterized by specific traits, strategies, opportunities, challenges, and future outlooks.

Identifying where a company sits within this matrix is crucial to understanding what the future might hold. It involves a thorough assessment of the company’s current DTC objectives and its risk tolerance. For instance, a company primarily focused on generating revenue with a low appetite for risk would align with The Protector Archetype.

An essential insight from this framework is the progression toward the right side of the matrix, which indicates a higher level of DTC maturity. Moving from a focus on revenue generation to controlling the brand experience suggests a deeper engagement with and utilization of DTC dynamics.

However, shifting a company’s level of risk appetite is generally more challenging. This aspect is often deeply ingrained in a company’s culture and influenced by its history, leadership, and market position. For instance, startups may naturally incline toward higher risk levels due to their need to establish a market presence quickly. In contrast, established companies might prefer a more conservative approach, prioritizing the protection of their existing market share, retail relationships, and reputation.

The DTC Archetype Framework is a reflection of broader trends in the retail and e-commerce sectors and provides a nuanced and comprehensive tool for companies to navigate the complex and rapidly evolving DTC environment. By understanding where they currently stand in this framework, companies can better strategize their growth, align with consumer expectations, and adapt to dynamic market conditions.

The Future of CPG for Your Archetype

As framed early on, there is no one-size-fits-all approach in DTC. Each company operates differently internally and within unique contexts externally. However, the above framework—and your archetype—can provide guidance regarding a future path, based on a company’s primary objective and risk profile.

The Protector

-

Relevant Market Changes: Continued digital consumer adoption, readily available plug-and-play e-commerce solutions, potential market threats from digital-native competitors, increased pressure on margins from retailers, competing for (in-store or online) shelf space.

The Protector should focus on introducing new—or optimizing current—e-commerce platforms, incorporating user-friendly interfaces and seamless payment options. They could explore data-driven product recommendations and slowly introduce AI for improved consumer experiences. Additionally, creating loyalty programs and time-limited offers would encourage repeat purchases without significant risk to any existing retail channels. Engaging in community-building through social media can also enhance brand loyalty within a controlled environment.

As an example, one of the world’s largest pet food manufacturers needed help sharpening the overarching strategy for their DTC team. Toptal brought in an expert DTC consulting team that helped gain internal alignment as well as set and execute a clear strategy. The company needed to develop customer journeys to identify how to capture new consumers and increase repeat purchases without risking their partnerships with major retailers. The team identified and built a consumer journey for their connected consumer experience that enabled DTC tactics, such as a site for consumers to compare products before getting funneled to retail partners’ sites to complete the transaction. This helped accelerate the e-commerce experience without impacting the retailers’ sales.

The Amplifier

-

Relevant Market Changes: Growing emphasis on data privacy, advanced data analytics, increased challenges in competing on product or pricing alone, consumer expectations regarding personalization.

The cautious, data-driven Amplifier should invest in sophisticated, privacy-compliant data analytics tools to gather deeper consumer insights that amplify product development, sales, and marketing efforts. They could use this data to tailor marketing campaigns and create personalized shopping experiences without significant disruption to any existing model or channels—for example, a loyalty app that records vital data on consumer buying behavior and can be used across merchants. Implementing consumer feedback loops to refine products and services would also be valuable. They should consider partnerships with tech firms to leverage emerging data technologies while maintaining a low-risk profile.

The Tester

-

Relevant Market Changes: Increased consumer desire for unique experiences, social and influencer marketing, competition against brand-centered native DTC brands across digital channels.

Companies aligned to The Tester archetype can focus on enhancing the online consumer experience with interactive elements like AR/VR for virtual product trials. Brand-savvy native DTC brands have been successful in quickly launching and growing sticky brands, so The Tester will need to experiment with interactions such as pop-up virtual events or limited-time collaborations with influencers to create buzz. For example, the furniture giant IKEA has the IKEA Place app, which uses AR technology to let customers visualize how furniture would look and fit in their homes before making a purchase. This innovative use of technology improves the customer experience by providing a useful tool for decision-making.

Implementing a consumer-centric design in their online platforms, with features like live chat support, can improve the user experience without significant investment or disruption.

The Mover

-

Relevant Market Changes: Constantly evolving marketing landscape, consumer purchase-savviness, increasing market competition.

More risk-comfortable, The Mover archetype should explore expansion strategies like entering emerging markets or tapping into unexplored consumer segments. They could consider strategic acquisitions to quickly gain market share, and either integrate new brands into their existing portfolio or retain them at arm’s length to protect established brands and channels. Investing in omnichannel marketing strategies and diversifying product lines to cater to broader demographics would also be beneficial. For example, Nike, a brand that’s not afraid to take calculated risks, has made strategic acquisitions, such as Converse, and invested in omnichannel strategies that highlight its pursuit of market expansion and consumer engagement, such as their DTC app. Nike’s diverse product line caters to a wide range of demographics, further showcasing its innovative approach to capturing broader market interests.

The Leader

-

Relevant Market Changes: Advanced data analytics, personalized marketing, data privacy and security expectations.

Investing in advanced data analytics and AI to gain deeper insights into customer behavior is key for The Leader. They should leverage this data for highly targeted and personalized marketing campaigns. Developing a highly data-driven omnichannel approach, integrating both online and offline touchpoints, would also enhance consumer engagement and result in deep insights to inform future strategies. The Leader might also explore dynamic pricing strategies based on consumer data insights.

The Disruptor

-

Relevant Market Changes: Technological innovations, changing consumer expectations regarding brand alignment, sustainability requirements across the value chain.

Bold and experiential-focused, The Disruptor should embrace cutting-edge technologies to create unique and immersive consumer experiences. This might include virtual reality showrooms or AI-driven personal shopping assistants. They could also experiment with innovative product lines or services that disrupt traditional market dynamics and tap into future expectations around sustainability, potentially through acquisitions or expansions. Engaging with consumers through digital storytelling and content marketing can also enhance brand engagement.

The Transformer

-

Relevant Market Changes: Major shifts in consumer behavior, disruptive technologies.

The commercially driven and visionary Transformer archetype should consider radical shifts like pivoting to entirely new business models or technology platforms to drive increased revenues through DTC. They need to consider how a full pivot toward DTC will affect previously relied-upon sales channels, such as through retail partners, and weigh short-term impacts. They might explore blockchain for enhanced transparency or invest in Internet of Things for connected product experiences. Entering into strategic partnerships or joint ventures could provide them with the necessary resources and expertise for transformative changes.

The Innovator

-

Relevant Market Changes: Cutting-edge data technologies, emerging consumer trends—particularly hyper-personalization.

Investing in emerging technologies such as AI, machine learning, and predictive analytics is crucial for The Innovator. This archetype should focus on developing hyper-personalized and niche products based on sophisticated consumer data analysis in order to maximize the value from emerging market shifts. Experimenting with new business models like subscription services or direct streaming of content can also open new revenue streams. The value will come from increasing utilization of the data collected, leveraging insights to inform future innovations. For example, Peloton gains deep insights into consumer behavior, informing its product development, marketing strategies, and channel decisions by investing heavily in advanced data analytics and AI. This enables Peloton to deliver highly personalized interactions, resonating with its user base and fostering a strong community around its brand. Moreover, Peloton’s integration of online and offline touchpoints through its app and physical products creates a seamless experience, enhancing consumer engagement.

The Strategizer

-

Relevant Market Changes: Global market shifts, sophisticated consumer demands, advanced technologies.

Experience-driven and highly comfortable with risk, The Strategizer should focus on global market trends and sophisticated consumer demands, integrating these insights into a comprehensive online and offline presence. They could explore innovative distribution channels like direct streaming or digital platforms for exclusive product launches. In order to future proof, they need to maintain an all-encompassing focus on the brand experience, even during turbulent times or lower revenues. Building strategic alliances with tech companies could also provide them with access to cutting-edge technologies and market insights.

The evolution of DTC in the CPG industry represents a complex yet rewarding journey. Embracing digital transformation and consumer-centric approaches is crucial for companies aiming to stay competitive. The future of DTC in CPG will likely be shaped by technological advancements, changing consumer behaviors, and the strategic alignment of brands with their consumers’ values and lifestyles. However, the opportunities and challenges will differ depending on which archetype a company most closely aligns to. As the industry continues to evolve, staying attuned to emerging trends and consumer preferences will be key for companies looking to capitalize on the opportunities presented by the evolving market.

Overall, the DTC model in the CPG industry is more than just a sales channel; it’s a direct conduit to understanding and catering to consumer behavior and preferences, essential for future growth and success in the industry.

Have a question for the Digital Customer Experience team? Get in touch.