AI in Finance: Opportunities and Challenges

After years of quiet evolution, artificial intelligence (AI) is now driving innovation in all industries at an unprecedented speed. Even the finance industry, a highly regulated sector that was initially slower to adopt the new technology, is beginning to use AI for analysis and forecasting, fraud detection and prevention, personal finance management, compliance-related tasks, and customer service and support. But challenges and opportunities remain ahead.

As recently as 2021, financial institutions were considered relatively immature in terms of AI deployment compared to other industries, and were projected to lag for the foreseeable future due to regulatory concerns, a lack of AI infrastructure, and a dearth of AI-trained workers.

But the rise of large language models (LLMs) and generative AI (Gen AI) at the beginning of 2023 sparked a change. According to forecasts by technology market research firm IDC, worldwide spending on AI hardware and services is set to exceed $500 billion by 2027, and financial service organizations are expected to double their AI spending during that time, reports the International Monetary Fund. That’s understandable, considering AI’s potential to reduce human error, predict market trends, speed document analysis, and churn through huge datasets. However, it could be catastrophic if the technology opened the door to sophisticated versions of theft, fraud, cybercrime, or even a financial crisis. Caution will continue to be the watchword, even as adoption accelerates.

In this article, three Toptal finance specialists—Carlos Salas Najera, former Head of Equities at London & Capital, Arvind Kumar, who’s worked globally with KPMG, Goldman Sachs, and EY, and David Quinn, a seasoned finance expert who runs his own wealth management firm—offer their insights about AI and finance.

How Is Artificial Intelligence Changing the Finance Sector?

Companies are embracing the abilities of AI and LLMs to simplify and speed up data-heavy tasks, pinpoint fraud, and improve customer service. Despite the slow start, it’s easy to see why the finance industry and finance teams within companies are accelerating their adoption of the technology.

“Over the last decade, a quick paradigm shift took place when institutions like BlackRock embraced AI and forced the rest of [the] players to play catch-up or get wiped out of the game,” says Salas, who specializes in AI and machine learning (ML) with a focus on investment applications. In 2023, BlackRock integrated AI across various facets of its operations to enhance investment strategies, improve client outcomes, and drive innovation. Salas adds that the benefits of using AI in finance—such as increased operational efficiency and the ability to make more thoroughly informed decisions—are already well documented. However, he noted that some investment firms have resisted AI due to the need to update legacy systems, the challenges of integrating the technology into existing financial models, and other potential risks.

Some of these barriers have been removed by the rapid expansion of ChatGPT and the gradual general acceptance of AI in our daily lives. “That reluctance diminished as more success stories and tangible benefits of AI adoption emerged,” explains Salas. “Additionally, regulatory bodies have become more receptive to AI applications in finance, further facilitating its implementation. Yet there are still many gaps in the regulatory frameworks that force many financial companies to adopt a wait-and-see approach.”

What AI Use Cases Are Companies Investing in Today?

A survey of approximately 400 financial services professionals around the globe highlights these applications:

|

Risk management |

36% |

|

Portfolio optimization |

29% |

|

Fraud detection (transactions/payments) |

28% |

|

Algorithmic trading |

27% |

|

Document management |

26% |

|

Customer experience |

26% |

Source: State of AI in Financial Services: 2024 Trends, Nvidia

4 Specific Areas Where AI in Finance Can Deliver Impact

Parsing Data

The most obvious benefit that AI offers to finance is its facility for reading, classifying, and extracting insights from datasets too large and complex for humans to manage effectively. That’s important: Companies usually collect massive amounts of information, even though more than two-thirds may never be used.

Unlike traditional bots and automation tools, machine learning algorithms can sift through data to identify and learn from patterns, enabling them to make predictions or decisions without explicit programming. This is particularly useful when analyzing loan applications, for example. Until recently, JPMorganChase relied on human workers to manually review and interpret commercial loan agreements, a process that was not only time-consuming but also prone to human error, due to the complexity and volume of the documents. To address this challenge, the bank developed a contract intelligence platform called COIN. Utilizing natural language processing (NLP), a branch of AI that helps computers understand, interpret, and produce human language, COIN extracts and analyzes key information from loan documents automatically.

The implementation of COiN dramatically reduced the time required to review documents, the bank told investors. What used to take the company’s lawyers and loan officers 360,000 hours annually can now be accomplished in just seconds and with fewer errors, speeding operations without a proportional increase in overhead costs.

According to Kumar, LLM tools can also be used for small-scale experimentation, even without fully fledged customized AI models or profound technical knowledge. “If there’s a business question where I have to think about four or five angles or four or five go-to-market strategies for a company looking to make a financial decision, I can just type the situation in ChatGPT or Gemini: ‘I am consulting on [type of project]. This is the kind of client, this is the context. What are the aspects that I should be looking at?’ The answers are not 100% accurate, but they’re a pretty good starting point if you have the experience to craft a good prompt and identify right answers from wrong.”

Optimizing Portfolios With Precision

Using AI, companies can tap into previously underutilized data in real time, greatly enhancing their ability to respond to changes in financial markets, a skill especially useful in trading. More than 40 years ago, Renaissance Technologies developed sophisticated algorithms to allow the fund to capitalize on very small price discrepancies in the market that exist for only seconds or milliseconds. This ability allowed Renaissance’s flagship Medallion fund to enjoy a virtually unmatched 63.3% return from 1998 to 2018.

LLMs can be fine-tuned to serve the same purpose even better than any algorithm could. Unlike traditional algorithms, LLMs can analyze vast amounts of unstructured data, understand complex patterns, and adapt to new information dynamically. This makes it possible to predict the behavior of financial markets faster and more accurately, potentially providing a significant edge in high-frequency trading and other investment strategies.

That’s the idea behind BlackRock’s newest venture into AI. Unlike general LLMs such as OpenAI’s GPT models, BlackRock uses specialized LLMs trained on narrower datasets specifically tailored for precise investment tasks, such as analyzing trends from earnings calls and predicting subsequent market movements. The benefit of narrower datasets is that they typically contain less irrelevant data, minimizing the likelihood of the model being influenced by extraneous factors and thereby reducing noise and potential errors. This approach helps the models focus on the most pertinent information, improving their ability to make precise and reliable predictions.

BlackRock has showcased the effectiveness of its tailored LLMs with comparative studies indicating that its models outperform larger, more generalized AI models in specific financial tasks.

This application of AI can also be implemented on a smaller scale, with much less investment, for smaller financial organizations, says Quinn, who was head of wealth management at a fintech startup before helping to orchestrate its successful exit to a major US bank. During his time at the startup, he began experimenting with a training algorithm to propose trades that would help get portfolios closer to their targets, while accounting for cash needs and withdrawals. “The algorithm suggested daily trades, which I would then review and approve or reject. This process helped create a valuable dataset for training an AI capable of predicting whether a human would approve a trade.”

The startup was acquired before Quinn could refine the tool, but in his current wealth management business, Quinn continues to use the technology he developed to predict client transactions. By analyzing data from custodial accounts, his algorithms identify recurring transactions and their frequencies, such as monthly contributions or withdrawals, to create a training set. The result allows the AI to anticipate cash flows without manual input. This approach leverages multiple algorithms and LLMs to enhance the client experience by focusing on prediction and thoughtful integration of data.

Supporting Compliance Tasks

As financial services become more complex, the tools firms use to support regulatory compliance must keep up. One area where some companies have been employing this capability is in helping to investigate financial crimes.

Following the discovery that UK-based bank HSBC was one of 17 banks used to launder at least $20 billion for organized crime, the company quickly brought in AI startup Ayasdi to better detect potentially suspicious financial transactions and flag them for investigation. Later, it partnered with the AI firm Silent Eight to use generative AI to automate routine tasks such as customer screening, transaction monitoring, and alert adjudication, which human operators traditionally handled.

HSBC credits the adoption of AI to combat money laundering with a reduction in the number of investigations needed by 20%. This efficiency gain lowered costs and allowed compliance officers to focus more on high-risk cases. Additionally, the company’s AI-driven systems have lowered the false positive rates in transaction monitoring, significantly reducing unnecessary reviews and streamlining compliance operations.

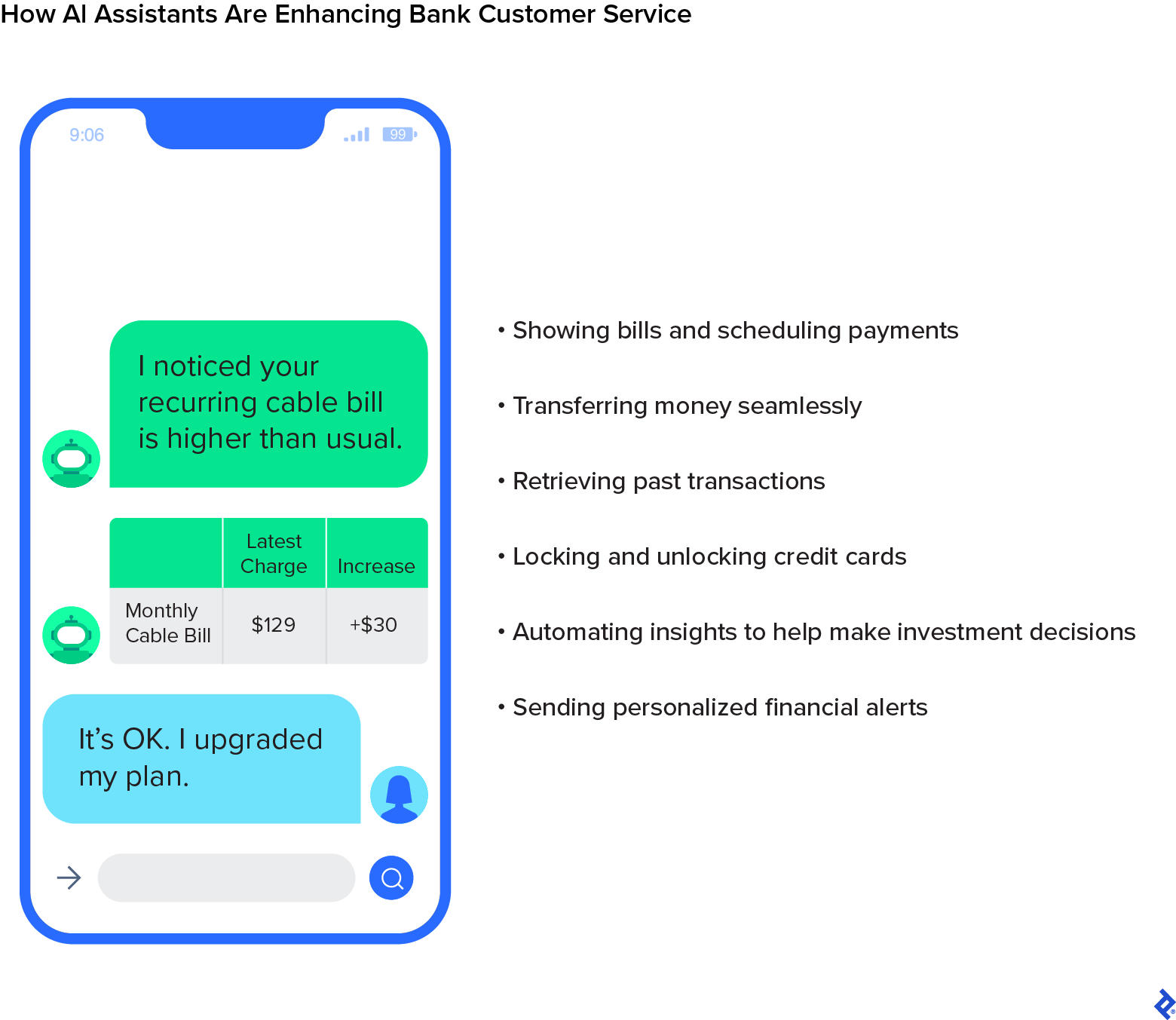

Using Robots in Customer Service

LLM-driven chatbots and virtual assistants are transforming customer service for financial organizations by using deep learning to autonomously manage routine inquiries and transactions. These systems engage with customers in real time, offering quick responses and services like checking account balances, initiating payments, and providing detailed transaction histories.

Bank of America’s chatbot, Erica, was the first such financial tool to offer advanced AI capabilities. Launched in 2018, Erica initially provided functionalities like predictive insights, proactive alerts, enhanced fraud detection, and personalized financial planning. The tool became popular for its ease of use and constant updates. By 2023, clients engaged with Erica 56 million times monthly to monitor and manage subscriptions, understand spending habits, track merchandise refunds, and check their FICO scores.

The use of similar robo-assistants has multiplied in the financial services industry, with examples like Citi Bot SG from Citi, NOMI from the Royal Bank of Canada, and Sandi from Santander. This trend aligns with customers’ current sentiment toward these services. According to a survey by Salesforce, 81% of banking customers now try to solve problems themselves with tools like chatbots before requesting human intervention.

How Can Financial Firms Navigate the Challenges of AI?

By now, there’s no lack of enthusiasm about using artificial intelligence in finance. Estimates from tech leaders like Nvidia and financial institutions like the European Central Bank generally anticipate that AI will make a very positive potential impact on all functions within a company, and the consensus among the financial experts Toptal consulted is that these institutions must invest in AI to maintain competitiveness. But since this field is evolving at such a rapid pace, there are many challenges that must be carefully managed to ensure successful AI deployment.

What Are the Biggest Challenges Companies Face in Achieving AI Goals?

A survey of approximately 400 financial services professionals around the globe cites these roadblocks:

|

Data issues: privacy, sovereignty, and disparate locations |

38% |

|

Recruiting and retaining AI experts and data scientists |

32% |

|

Lack of budget |

28% |

|

Lack of sufficient data for model training and accuracy |

27% |

Source: State of AI in Financial Services: 2024 Trends, Nvidia

Maintaining Robust Security

Maintaining data security is of paramount concern for the finance industry. These companies handle vast amounts of sensitive data, including personal information, transaction histories, and potentially confidential business information. The integration of AI in finance necessitates handling this data in ways that protect it against breaches and unauthorized access. Ensuring data privacy can involve encrypting data, securely storing and processing data, and implementing robust access controls, among many other safeguards.

“A crucial point to consider is that collecting more data to enhance our machine learning and AI capabilities also means housing more data, increasing our risk exposure,” says Quinn. “Therefore, having a robust policy around data management and data security is critically important.”

Regulatory frameworks like the General Data Protection Regulation (GDPR), the California Consumer Privacy Act (CCPA) in the US, and the European Union’s newly approved AI Act impose strict rules on data handling, which pushes financial institutions to adopt AI solutions capable of complying with these laws. Penalties under these regulations can be substantial. For example, the GDPR can impose fines of up to €20 million or 4% of a company’s global annual revenue. The CCPA can levy fines of up to $7,500 per intentional violation and $2,500 per unintentional violation.

Ensuring High Data Quality

AI models are only as good as the data they are trained on, so a related challenge to manage is checking that the data used is clean, meaning that it is accurate, complete, and free of inconsistencies. “Even the best model will face obstacles, so we must consider what data will be collected to further enhance our machine learning intelligence. It’s not simply a matter of creating an algorithm at one point in time and leaving it at that,” explains Quinn. “The algorithm needs to continuously update its parameters over time, based on additional training sets and observations, to refine its accuracy and effectiveness. So the questions companies need to address are: How will we collect this data? How will we clean it?”

Finding Talent With AI Skills

The data quality challenge leads to the third obstacle on the way to AI adoption: finding the right talent to tackle all the related tasks and responsibilities. According to a recent report from Rackspace Technologies, two-thirds of IT leaders cited the shortage of skilled AI talent as their main roadblock for their AI initiatives. The tech and its applications are so new that the AI experts capable of coordinating complex deployments are few and highly sought-after, limiting the number of companies capable of accessing their services.

Another issue regarding talent is that bringing AI into any team will not necessarily translate into efficiency. A study from Harvard Business School found that AI can improve work quality by up to 40%—but only if it’s in the hands of highly skilled people working on the right tasks. If you use AI for jobs it’s not suited for, such as qualitative analysis, performance can drop by 19%, no matter how skilled the user is. Human intelligence still matters.

“AI is definitely something that takes a lot of tinkering,” Kumar says. “You can come to a problem thinking you’ll solve it with automation, but then you see the first results, and everything is harder than you imagined. You have to commit [to the process], because you won’t hit a home run after seeing the first pitch.”

The Cost of AI Implementation

Beyond the technical and talent hurdles, the financial commitment required to implement AI can be substantial and often prohibitive. “Training Meta’s largest AI model, which consists of more than 65 billion parameters, uses 2,048 specialized Nvidia GPUs, taking about 21 days, or the equivalent of 1 million GPU hours, to do it effectively. If a company wanted to train a similar model for its own purposes, it would cost roughly more than $2.4 million,” says Salas. “Using those numbers as a reference, Bloomberg’s GPT model, specifically fine-tuned for financial operations, could cost between $1.2 million and $1.8 million.”

This financial barrier limits the deployment of AI in finance primarily to large institutions, leaving smaller firms at a competitive disadvantage unless they can access more cost-effective AI solutions through third-party providers or partnerships. This is even before considering that many financial institutions operate on legacy IT infrastructures that were not designed to support the latest AI technologies.

“I’d prioritize those technologies that are straightforward to implement, focused on cost control, and for which many vendors can provide a service,” advises Salas. Additionally, he recommends a dual approach: automating routine tasks now while still investigating new, untested technologies. The best strategy would vary depending on the financial firm’s sub-industry and its technological maturity compared to its peers.

Is AI the Future of Finance?

As artificial intelligence rapidly evolves, financial organizations must embrace continuous innovation and adaptability to stay ahead. Developing financial AI technologies requires a proactive approach, including investing in ongoing staff training, updating systems regularly, and experimenting with new AI applications.

Collaboration is also critical in the financial industry, especially when dealing with the complexities of AI. No single institution can address these challenges alone. By forming partnerships with banks, fintech companies, regulators, and technology providers, companies can tackle common issues like data privacy, AI model accuracy, and compliance with regulations. Such collaborative efforts can lead to shared solutions and help set industrywide standards and best practices for AI usage, ensuring a unified and ethical approach to integrating technology into financial services organizations.

But in the shorter term, our three Toptal experts agree on one main takeaway for financial companies and finance departments leveraging their next AI project: Be patient and keep expectations realistic. Salas says that while AI offers immense potential, it is not a panacea, and its implementation requires careful consideration of ethical, regulatory, cultural, and technical challenges. Firms should focus first on building robust infrastructure, investing in data quality and governance, and fostering a culture of innovation and continuous learning to truly unlock the benefits of AI in finance. If an organization does all these things correctly, the rewards should flourish in time.